We recently spoke with a home tutor about how she manages her business. She showed us her Excel spreadsheet—payment dates, student names, and amounts all carefully organised. Then she mentioned she'd accidentally deleted a formula last week and spent hours fixing it. It was also hard to update the spreadsheet from her phone when parents paid during lessons.

As we thought about her situation, we realised other service providers probably face the same issue. Personal trainers, music teachers, freelance consultants—anyone with 10-30 regular clients likely deals with similar frustrations.

What We Learned About Payment Tracking

Most service businesses seem to follow a predictable path:

- Under 5 clients: Excel or notebooks work fine

- 5-50 clients: Things get messy—too many for manual tracking, but enterprise software feels excessive

- 50+ clients: Time for proper CRM and payment systems

That middle group is where things get frustrating. You know spreadsheets aren't cutting it anymore, but you're not ready to learn (or pay for) complex software.

What PayMark Does

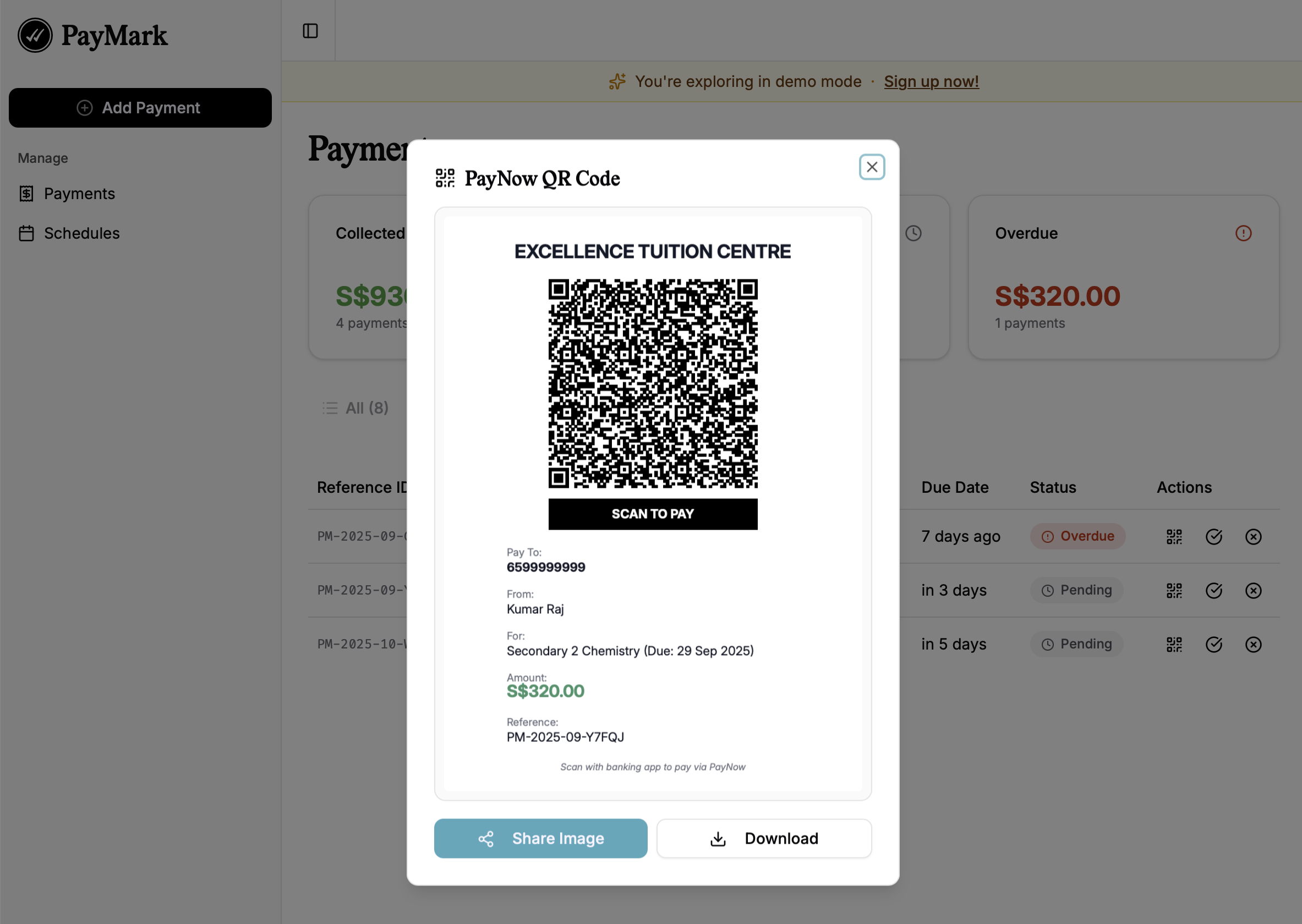

We built PayMark to fill this gap. It's a basic tool that handles a few things:

- Set up payments and recurring schedules

- Generate PayNow QR codes that prefill payment details in banking apps

- Create reference IDs that match your bank statements

- Keep everything organised without credit card processing fees

It's not revolutionary. We're not reinventing payments. We just made a tool that does what those Excel spreadsheets are trying to do, but without the headaches.

Why We Built This

During our research, we noticed these service providers had already figured out their own systems—they just needed slightly better tools. They didn't want payment processing or automated invoicing. They just wanted their existing process to work better.

Also, when you eventually outgrow PayMark and need something bigger, your data is already organised and digital. Moving to a proper CRM becomes much easier when you're not starting from paper records or scattered spreadsheets.

Try It Out

PayMark is free to use. No credit card needed. We set up a demo environment if you want to see how it works before signing up—it has sample data that resets every hour.

We hope this tool that might make payment tracking a bit less painful for service providers with regular clients. If that sounds useful, give it a try.

Try PayMark for free and see if it fits your workflow. Sometimes the best solutions are the simple ones.